Stamp Duty and Registration Charges in Pune: Your Complete Guide

Pune, known for its rich culture, educational institutions, and growing IT sector, has become a hotspot for real estate investment. If you’re considering buying property in Pune, it’s essential to understand the various costs involved, including stamp duty and registration charges. These charges are crucial aspects of property transactions and can significantly impact your overall budget. In this guide, we’ll provide an in-depth overview of stamp duty and registration charges in Pune, helping you navigate the real estate market with confidence.

Understanding Stamp Duty

Stamp duty is a type of tax levied by the government on the purchase or transfer of property. It is calculated as a percentage of the property’s market value or the agreement value, whichever is higher, and is a legal requirement for property transactions to be considered valid.

Why stamp duty is Essential in Pune Property Transactions?

– Legal Requirement

– Revenue Generation

– Ownership Rights

– Regulatory Purpose

– Fraud Prevention

What are Registration Charges?

Registration charges are fees paid to the government for registering the property transaction. These charges are separate from stamp duty and are calculated as a percentage of the property’s market value or the agreement value, whichever is higher. In Pune, the registration charges are generally around 1% of the property’s market value or the agreement value.

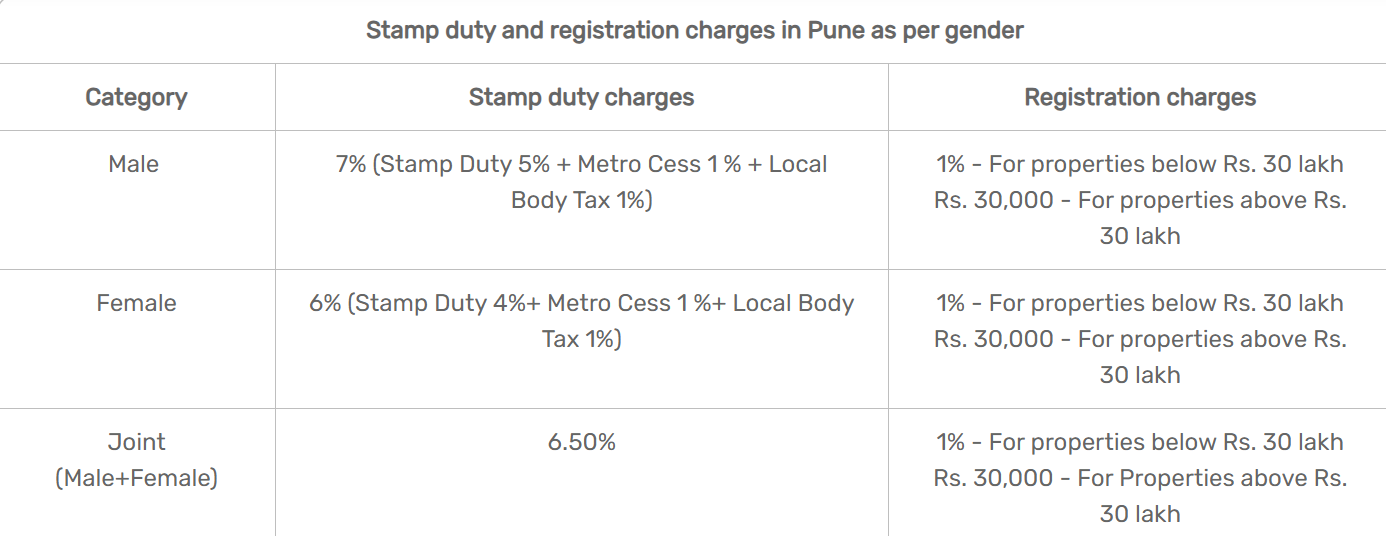

Stamp Duty and Registration Charges in Pune

Please note that these rates are subject to change based on government regulations.

How to Calculate Registration charges and Stamp Duty in Pune?

- Determine the Property Value: The first step is to determine the property’s market value or the agreement value, whichever is higher.

- Calculate Stamp Duty:

Stamp Duty = Property Value × Stamp Duty Rate

- Calculate registration charges:

Registration charges in Pune are generally around 1% of the property’s market value or the agreement value, whichever is higher. Registration Charges = Property Value × 1%

- Total Cost:

Total Cost = Stamp Duty + Registration Charges.

How to Pay Stamp Duty and Registration Fees in Pune?

Paying stamp duty and registration fees in Pune can be done both online and offline.

Online Payment:

- Calculate the Fees: Calculate the stamp duty and registration fees based on the property value.

- Fill in Details: Fill in the required details such as property details, payment details, and personal information.

- Visit the Website: Go to the Maharashtra government’s official website for property registration and stamp duty payment (https://efilingigr.maharashtra.gov.in/)

- Make Payment: Choose the online payment option (credit/debit card, net banking, etc.) and complete the payment.

- Download Receipt: After successful payment, download and save the receipt for future reference.

- Register the Property: Once you have paid the fees online, you will need to visit the Sub-Registrar’s Office to complete the registration process by submitting the required documents.

Offline Payment:

- Calculate the Fees: Calculate the stamp duty and registration fees based on the property value.

- Visit the Bank: Visit the nearest designated bank authorized to collect stamp duty and registration fees.

- Fill in Challan Form: Fill in the challan form with the necessary details such as property details, payment details, and personal information.

- Make Payment: Pay the stamp duty and registration fees in cash or through a demand draft as per the instructions provided by the bank.

- Collect Receipt: Collect the payment receipt from the bank as proof of payment.

- Register the Property: After paying the fees offline, visit the Sub-Registrar’s Office to complete the registration process by submitting the required documents.

Factors That Affect Stamp Duty in Pune

- Property Value: Stamp duty is calculated based on the property’s market value or agreement value, whichever is higher.

- Property Type: Residential, commercial, and industrial properties may have different stamp duty rates.

- Location: Stamp duty rates can vary between urban and rural areas.

- Gender of Property Owner: In some cases, stamp duty rates may differ based on the gender of the property owner.

- Joint Ownership: Stamp duty rates for joint ownership properties may vary based on the ownership structure.

Tax Benefits Available on Stamp Duty and Registration Charges

In India, tax benefits are not available on stamp duty and registration charges directly. However, these charges are considered part of the cost of acquiring the property and can be included in the cost of acquisition for the purpose of calculating capital gains tax when the property is sold in the future.

Here’s how it works:

- Capital Gains Tax: When you sell a property, the profit you make is considered capital gains. There are two types of capital gains tax – short-term capital gains tax (for properties held for less than 2 years) and long-term capital gains tax (for properties held for more than 2 years).

- Cost of Acquisition: The cost of acquisition includes the purchase price of the property along with any expenses incurred in acquiring the property, such as stamp duty, registration charges, and brokerage fees.

- Indexed Cost of Acquisition: For long-term capital gains tax calculation, the cost of acquisition is adjusted for inflation using the Cost Inflation Index (CII) published by the Income Tax Department. This adjusted cost is known as the indexed cost of acquisition.

- Tax Benefits: While you cannot claim a deduction for stamp duty and registration charges directly, including these costs in the cost of acquisition can reduce your capital gains tax liability when you sell the property in the future.

FAQs

About Stamp Duty and Property Registration Charges in Pune.

What documents are required for property registration in Pune?

For property registration in Pune, you typically need the following documents:

- Sale deed or agreement of sale

- Proof of identity (Aadhar card, passport, PAN card, etc.)

- Proof of address (utility bills, driving license, etc.)

- Property card or extract

- NOC from relevant authorities (if applicable)

Does stamp duty in Pune include GST?

No, stamp duty in Pune does not include GST (Goods and Services Tax). Stamp duty is a state-level tax levied on property transactions, while GST is a central tax applicable to the sale of goods and services.

How is stamp duty calculated for joint ownership properties in Pune?

In Pune, stamp duty for joint ownership properties is calculated based on the property’s market value or the agreement value, whichever is higher. The stamp duty rates vary based on the type of property (residential, commercial, industrial) and the gender of the owners (men, women, or a combination of both). Each owner’s share of the property is considered when calculating the stamp duty, and the total stamp duty payable is the sum of the individual shares.

What are the penalties for late payment of stamp duty and registration charges in Pune?

In Pune, penalties for late payment of stamp duty and registration charges can vary. However, typically, a penalty of 2% per month on the outstanding amount may be levied for late payment. It’s advisable to check with the local Sub-Registrar’s Office for the exact penalties applicable to your situation.

Are there any special provisions or considerations for NRI property buyers regarding stamp duty and registration charges in Pune?

Yes, there are special provisions for NRIs (Non-Resident Indians) regarding stamp duty and registration charges in Pune. NRIs may be subject to different stamp duty rates compared to resident Indians, and they may also have to comply with additional documentation requirements. It’s advisable for NRIs to consult with a legal advisor or the local Sub-Registrar’s Office to understand the specific provisions and considerations applicable to their property transaction in Pune.

Conclusion

Understanding stamp duty and registration charges is crucial for property buyers in Pune. These charges, based on property value and location, can significantly impact transaction costs. By knowing the rates, calculation methods, and payment processes, buyers can navigate the property market effectively. Consulting legal advisors or local authorities ensures compliance and smooth transactions. Overall, being informed about these charges helps buyers make informed decisions and avoid pitfalls when buying property in Pune.